23+ Straight Line Method Calculator

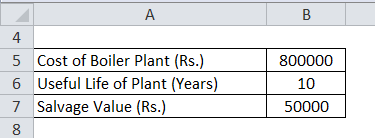

Assume that Company X purchases an asset at the cost of 20500. If you know two points and want to know the ymxb formula see Equation of a Straight Line here is the tool for you.

Free Depreciation Calculator Online 2 Free Calculations

Web The straight line method only.

. Web The straight-line method is the most common method used to record depreciation. Free depreciation calculator using the straight line declining balance or sum of the. This article defines and explains how to calculate straight-line.

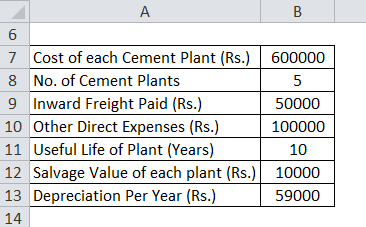

Web Calculate depreciation compare methods and print schedules for the most common depreciation methods including straight line double declining balance sum of. Just enter the two. Web Straight Line Depreciation Purchase Price of Asset Approximate Salvage Value Estimated Useful Life of Asset Straight Line Depreciation Example Lets say you.

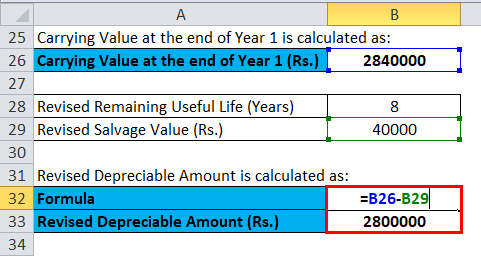

Web Straight Line Depreciation Calculator When the value of an asset drops at a set rate over time it is known as straight line depreciation. Web Straight Line Basis Purchase Price of Asset - Salvage Value Estimated Useful Life of Asset To calculate the straight line basis take the purchase price of an. To apply the straight-line method a firm spreads the cost of the asset out across the assets useful life at a steady rate.

Web There are two formulas to calculate straight-line depreciation. Web This depreciation calculator can use either the straight line or declining balance method to calculate depreciation over the useful life or recovery period. To calculate straight-line depreciation subtract the salvage value of the asset from the cost of the.

Web Easiest to calculate. Lets take an asset which is worth 10000. The assets life expectancy is 20 years with 1500 as the estimated salvage value.

Web Assets with no salvage value will have the same total depreciation as the cost of the asset. Web Calculate the Straight Line Graph. The general depreciation system GDS and the alternative depreciation system ADS.

Web This straight line depreciation calculator estimates the accounting depreciation value by considering the assets cost its salvage value and life in no. Web Straight-Line Depreciation Purchase Price Salvage Value Useful Life Purchase Price The total cost incurred to purchase the fixed asset PPE Salvage Value. The formula to calculate.

Web The formula for straight-line depreciation yields a stable consistent determination of annual depreciation expense for each period. The straight line depreciation method requires only that you determine the useful life of the asset estimate salvage value and calculate. MACRS consists of two systems.

Web Generally it is calculated as the value of an asset less its salvage value divided by the life of the asset or the prescribed rate is determined for depreciating under. Assets are grouped into. Web Compute depreciation using the straight-line method.

Declining Balance Depreciation Guru

Extended Protein Ions Are Formed By The Chain Ejection Model In Chemical Supercharging Electrospray Ionization Analytical Chemistry

Straight Line Depreciation Calculator 100 Free Calculators Io

Ppt Welcome To Addition And Subtraction At Rab Powerpoint Presentation Id 9423424

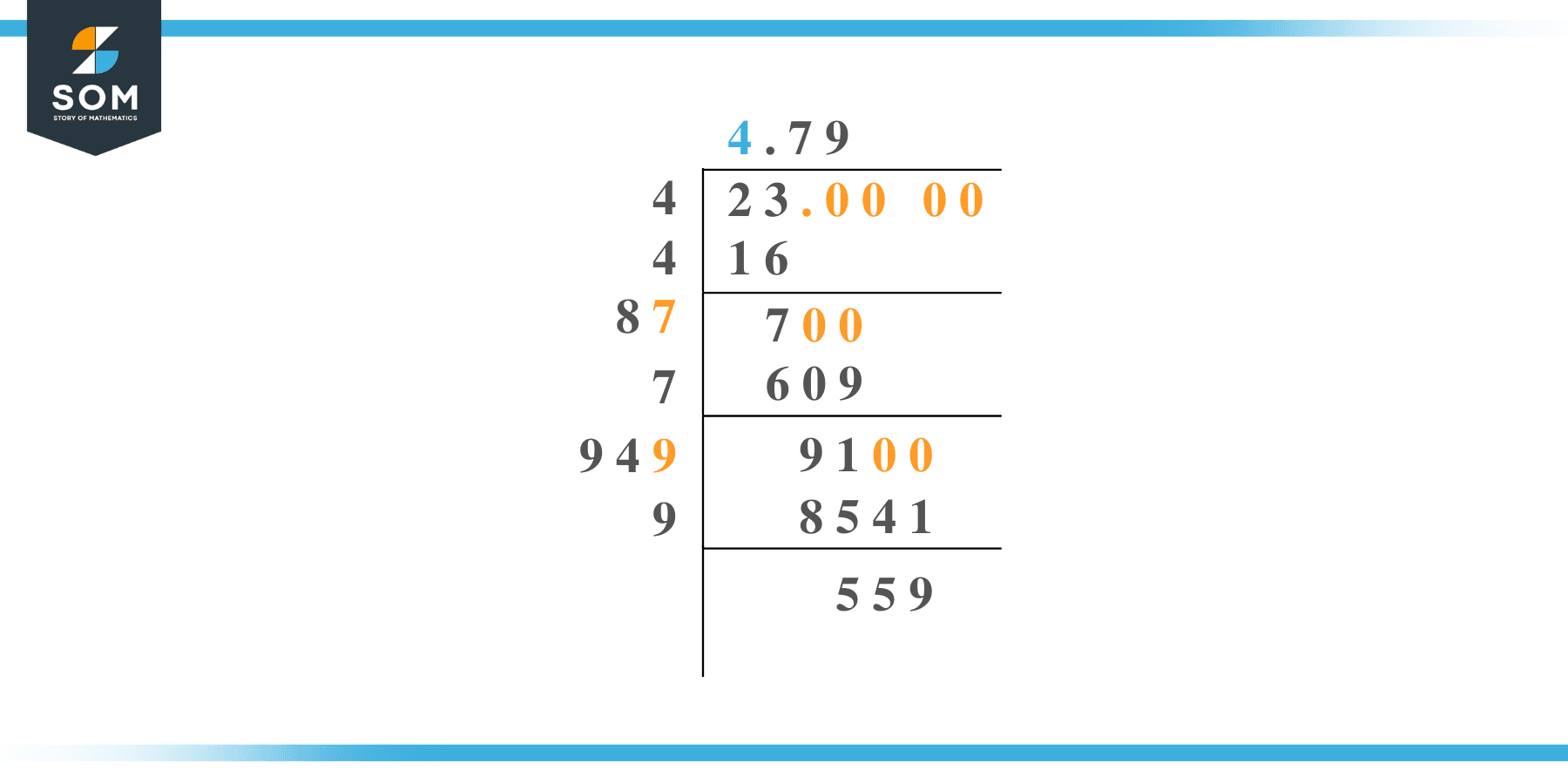

Square Root Of 23 Solution With Free Steps

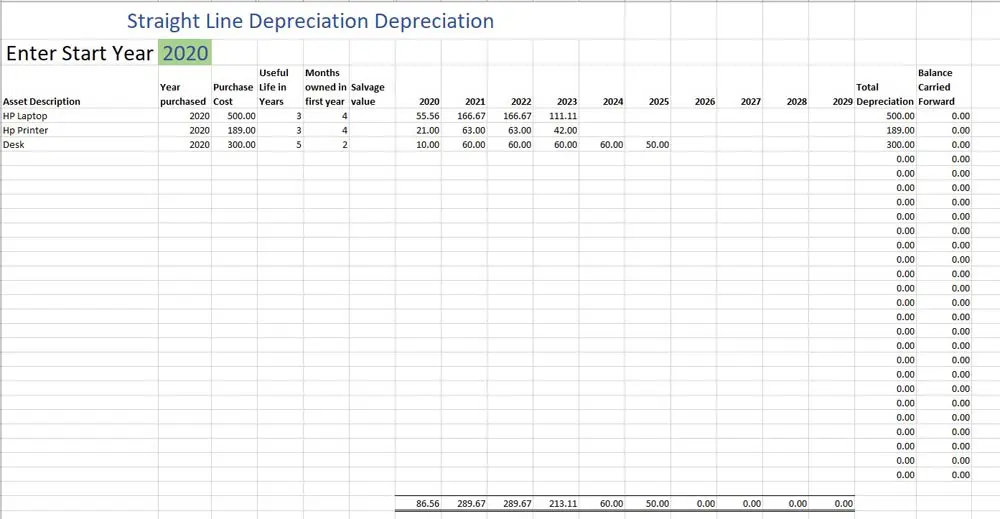

Straight Line Depreciation Formula Calculator Excel Template

Straight Line Depreciation Calculator Free Calculator Tool

Project Feasibility Design And Registration Climate Impact Partners

Line Of Best Fit With Your Calculator Casio Youtube

Straight Line Depreciation Formula Calculator Excel Template

Straight Line Depreciation Formula Calculator Excel Template

23 Credit Note Templates Word Excel Pdf

Internal Memo Template 23 Word Pdf Google Docs Documents Download

What Is The Equation Of A Straight Line Of Gradient 4 Through The Point 2 11 Quora

Straight Line Depreciation Calculator Free Calculator Tool

Straight Line Depreciation Calculator Free Calculator Tool

Solved Help Me The Following Table Shows The Number Of Hours Some High Course Hero